As risks are instantly proportional to returns, if a financial institution forex liquidity aggregation takes more risks, there is a higher probability for it to earn more money. Banking and finance aspirants making ready for upcoming authorities and aggressive exams will have to have a clear understanding of all of the risks current in the banking sector. Hence, the under article is intended to guide candidates accordingly with apt and most up to date data as per the Reserve Bank of India (RBI) guidelines.

2 Financial And Monetary Statistics

These aggregates embody numerous types of cash, from bodily currency to several varieties of deposits. The Reserve Bank of India (RBI) makes use of monetary aggregates similar to M0, M1, M2, M3, and M4 to understand the money provide within the Indian economy. These platforms hook up with numerous liquidity suppliers, including decentralized exchanges (DEXs), centralized exchanges (CEXs), liquidity swimming pools, market makers, and different trading venues.

Risks In Banking Sector: Which Means, Types, Detailed Rationalization For Banking Awareness

According to recent Reserve Bank of India data, the uncertainty brought on by the Covid-19 pandemic has led to a surge within the cash provide. The currency held by the public increased by 8.2% since March-end 2020 and the financial savings and current account deposits decreased by 8%. A digital present account is a kind of bank account that exists electronically and could be accessed online or through a cell app. It features similarly to a standard present account, permitting you to deposit and withdraw funds, make payments, and check your stability.

C/4hana: Delivering Customer Centric Processes, Enhancing Outcomes And Building Buyer Loyalty

All trade transactions – import and export are recorded within the current account of the country. These accounts are particularly designed for businesses involved in import and export activities. It integrates trade finance solutions like letters of credit score and documentary collections. These accounts are geared towards companies requiring subtle cash move management instruments. It provides features like automated collections, account aggregation, and superior reporting. We have been engaged to know the challenges confronted by the consumer and provide solutions that might automate the treasury and integrate it with other finance processes.

What Are The Completely Different Components Of The Financial System?

Documentation of various positions of financial devices, money flows and historic accounts are extra reliable and up-to-date. The resolution meets crucial requirements for auditing and better safety of knowledge due to access control. The entities that present financial companies, such as banks, credit unions, insurance coverage companies, investment banks, and pension funds, are referred to as monetary establishments. They act as intermediaries between savers and debtors, channeling funds from savers to debtors.

- You can read more about the old monetary aggregates within the ClearIAS article on the money supply.

- 📈🧠 This indicator is engineered to decipher the actions of sensible cash buyers relative to the much less informed (dumb money) and dynamically display their dominance within the trading…

- By subjecting their portfolios and steadiness sheets to simulated tense conditions, they’ll determine vulnerabilities, measure potential losses, and take corrective actions to mitigate danger.

- This software harnesses unique algorithms to detect liquidity imbalances between bulls and bears, serving to traders spot trends and potential entry and exit factors with higher accuracy.

M3 known as Broad money as along with liquid deposits it additionally includes time deposits thus making it a broad classification of Money. To know concerning the totally different monetary systems within the economic system, check with the linked article. It is essential to notice that if the MAB requirement just isn’t maintained, the bank may levy a penalty, which can vary from a nominal amount to a percentage of the shortfall in the MAB. The penalty can range depending on the financial institution and the specific terms and circumstances of the account.

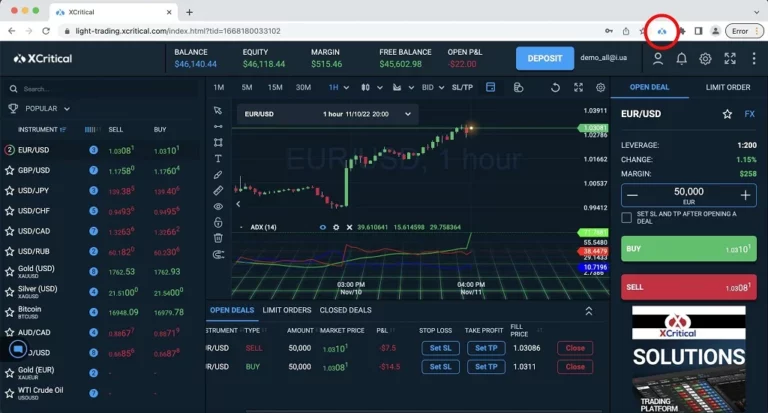

The main members of the liquidity aggregation course of are liquidity swimming swimming pools – particular spaces the place liquidity suppliers’ funds are positioned. Liquidity aggregation is a technique of gathering buy and promote orders from completely totally different sources and directing them to the executing celebration. The function of aggregation is to provide retailers with a risk to purchase an asset at prices close to market common. Liquidity aggregation is the process of bringing collectively liquidity from totally different sources to facilitate environment friendly buying and selling. Several central banks are exploring the event of digital currencies issued and backed by central banks, generally recognized as CBDCs.

Betting Exchange Live: Get Reside Betting Odds & Expert Suggestions In India Today – Be A Part Of Now!

Financial methods allow individuals, businesses, and governments to entry the capital needed for investment in productive actions. They present numerous funding options corresponding to stocks, bonds, and venture capital, allowing entities to lift funds to expand operations, launch new initiatives, or develop infrastructure. Financial techniques act as intermediaries between savers and debtors, channeling funds from those who have extra funds (savers) to those who want funds (borrowers). This intermediation process facilitates the efficient allocation of capital and promotes financial development. Many banks supply free present accounts, however some may charge a payment for sure providers.

Records of all loans with the sanctioned amount, drawdown, switch to sub-accounts, curiosity funds, compensation dates and instalments, and so on., have been maintained in Excel, resulting in handbook controls. There was no integration with financial accounts and all entries have been re-entered in SAP-FI/CO, thereby requiring duplication of knowledge entry, reconciliations, etc. On stability sheet and off-balance sheet publicity was handled manually for both import and export. Monetary aggregates, also called cash supply measures, are very important instruments used by central banks and economists to gauge the entire provide of money circulating within an economic system.

First, let’s look at a variety of the main robust sides of liquidity aggregation within the crypto market. The objective of financial intermediation is to channel funds from savers to debtors and facilitate environment friendly economic capital allocation. Robo-advisors have gained recognition as automated funding platforms that use algorithms and artificial intelligence (AI) to provide personalized funding advice and portfolio management services.

Tamta is a content writer primarily based in Georgia with five years of expertise overlaying world financial and crypto markets for information outlets, blockchain corporations, and crypto corporations. Capital markets, corresponding to stock exchanges and bond markets, facilitate the issuance and buying and selling of securities. They present a platform for firms and governments to lift long-term capital for funding purposes. Investors, in turn, can buy and sell these securities, permitting for the switch of capital to the most promising initiatives or entities. The savers’ funds are channeled to debtors or buyers with productive capital makes use of. This capital allocation course of helps finance financial activities like business enlargement, infrastructure improvement, or innovation.

Liquidity provision refers to the financial system’s availability of liquid belongings and funding sources. It is important to ensure institutions can access money and meet their obligations, maintaining confidence and stability. Banks play a crucial role in the monetary system by intermediating between savers and debtors, accepting deposits, providing loans, and facilitating funds and transactions. However, they are not with out their flaws and vulnerabilities, as evidenced by historic monetary crises. Blockchain know-how, which permits safe and clear peer-to-peer transactions with out intermediaries, has gained important consideration.

Supervisory bodies monitor the monetary health of institutions, assess risk administration practices, and enforce compliance with rules to safeguard the monetary system’s stability. The monetary system enhances liquidity, manages risks, and fosters confidence among traders, encouraging funding and economic activity. Additionally, it performs a vital position in facilitating worldwide trade and investment, supporting government financing, and creating opportunities for entrepreneurship and job creation. The types of accounts that may be opened are – Savings account, Fixed deposit, and Recurring deposit.

From 1977, RBI has been publishing 4 financial aggregates – M1, M2, M3 and M4 – in addition to the reserve cash. Very often, the money supply within the economy is represented using a financial mixture referred to as ‘broad money’, additionally denoted as M3. The money supply is the entire value of money out there in an economic system at a point of time. Volume Delta Candles offers insights about Intrabar buying and selling exercise in an easy-to-interpret method.

Read more about https://www.xcritical.in/ here.